Figuring out how to profit from real estate is truly not that tough. A little information, a couple of methodologies and systems can create a lovely way to heaps of cash. Numerous real estate financial specialists started with almost no cash and today they are tycoons. But, to profit from real estate business requires significant investment, increasing judicious information of the business sector and how to utilize the timing. Utilize the time wisely and realize a few procedures and watch your financial balance develop.

Figuring out how to profit from real estate is truly not that tough. A little information, a couple of methodologies and systems can create a lovely way to heaps of cash. Numerous real estate financial specialists started with almost no cash and today they are tycoons. But, to profit from real estate business requires significant investment, increasing judicious information of the business sector and how to utilize the timing. Utilize the time wisely and realize a few procedures and watch your financial balance develop.

According to Jeff Adams real estate guru, you don’t generally require multifaceted courses or a real estate permit to start. You can increase the insight from the Web to guide you in this career. In this article we are also going to provide you a few tips that shall be effective for you.

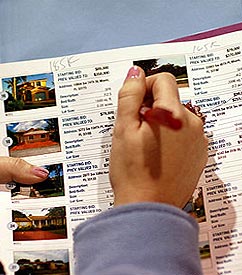

There are a few methods to profit from the real estate market. Buying so as to flip homes low and offering high is one system where you can profit a good amount from the home. You contract to buy a home and line up another purchaser to go to the settlement, purchase the home and the proprietor gets his price; the new purchaser you lined up, pays what you expected and you take the benefit.

This method includes alternatives, where the agreement you have with the proprietor has a choice to offer to another purchaser. However, that is only one strategy to profit from real estate.

Another Jeff Adams real estate tips to make money is the tax liens. This is one of the most secure types of real estate investments. A mortgage holder falls behind and is not able to pay their property charges. The region they live in puts a lien on the property and can abandon if assessments are not paid within a certain time allotment. You go to the county taxes and evaluations and buy the duty lien.

The property holder will have a sure measure of time to pay you with interest or they will lose their home to you. Numerous states do have high rates of interest on tax liens – and can be as high as 24 percent. Numerous real estate investors either gather their investment along with interest to offer at a benefit.

A lot of speculators are additionally making fortunes in home foreclosures. It’s absolutely sad to see somebody lose their home; but for the real estate financial specialists hoping to profit from real estate, home foreclosures can make you millions.

Real estate foreclosures and pre-foreclosures are both purchased at low business sector price. At the point when a bank recovers their property from a mortgage holder as a result of non-installment it is never exchanged at market price. A home worth $250,000 can be attained for $100,000.

Another important real estate investing tips is you can buy homes that can be leased and have enduring rental wage while others purchase low to sell high. In both ways anybody can profit from real estate. It just takes a little learning and your speculation of time.

###

A lot of agents are willing to sell the

A lot of agents are willing to sell the  The initial step to turning into a specialist in

The initial step to turning into a specialist in  To exceed expectations in this business you should know your neighborhood

To exceed expectations in this business you should know your neighborhood

Acknowledging what your specific needs is really important before you delve deep into

Acknowledging what your specific needs is really important before you delve deep into